Revista Industrial Data 27(2): 257-277 (2024)

DOI: https://doi.org/10.15381/idata.v27i2.27989

ISSN: 1560-9146 (Impreso) / ISSN: 1810-9993 (Electrónico)

Financing Cost for MSE (Micro and Small Enterprises) Loans Through the Reactiva Perú Program in a Financial Institution and its Competitiveness in the Peruvian Financial System, 2019-2020

Jose Alberto Saravia Saravia[1]

Submitted: 27/09/2023 Accepted: 11/04/2024 Published: 31/12/2024

DOI https://doi.org/10.15381/idata.v27i2.26238.g20457

ABSTRACT

This research article aims to examine the trends in the financing costs of loans granted by Peruvian financial institutions in 2019 compared to 2020. This comparison serves to illustrate the trends in access to credit for micro and small enterprises (MSEs) and how they were affected by the crisis caused by COVID-19 in Peru

Keywords: financing, MSEs, interest rate.

INTRODUCTION

According to the study conducted by the Cámara de Comercio de Lima (2020), credit at the corporate level grew by 5% in October 2019 compared to October 2018, so there was some expectation of growth for 2020 without considering the impact of the future COVID-19 pandemic.

In 2020, the spread of the COVID-19 virus in Peru was an event of such notable incidence that the Central Government had to adopt measures as a matter of urgency to curb its spread. This was done without considering that such measures would have a significant impact on the productive and economic aspect of the companies that caused a decrease in income due to the inactivity of various economic sectors in the country that, according to the Instituto Peruano de Economía (2020), generated a 30% contraction in the national GDP in the second quarter of the year 2020. This caused an urgent need for liquidity so companies would be able to meet their short-term commitments both internally and with their liabilities. It meant there was a high probability of breaking the company's payment chain, which could seriously threaten its sustainability.

For this reason, the Central Government adopted certain economic coverage initiatives favoring companies, mainly MSEs. One of these initiatives was the Reactiva Perú fund[2], administered by COFIDE[3], through a trust fund whose purpose was to grant financing with better credit conditions than those existing in the Peruvian market to companies with a guarantee granted by the government.

The purpose of this research was to determine the contribution to knowledge of this initiative as a solution to this type of situation. It also sought to reflect on and analyze the impact of one of the Government's programs for business sustainability in Peru, which was the Reactiva Perú program. The research was conducted on a financial institution within the Peruvian financial system and focused on the cost of financing under certain conditions and the competitiveness of the financial cost to the Peruvian financial system.

The results of this study can be used as a premise to encourage the analysis of the various business sustainability and payment chain support programs implemented by the Government through the Ministry of Economy and Finance (Ministerio de Economía y Finanzas, 2020), such as the Fondo de Apoyo Empresarial (FAE MYPE) and the Fondo Crecer[4]. These programs, together with the Reactiva Perú program, are mutually exclusive, which means that a company can only access one of these three funds, and their purpose was to boost and support the national economy in times of crisis, as was the case during the COVID-19 pandemic.

The main objective of this study is to determine to what extent the interest rate granted by the financial institution under study for the Reactiva Perú program loans to MSEs would be competitive in the Peruvian financial market.

In line with the objective previously described, the hypothesis of this study seeks to demonstrate whether the interest rate granted by the financial institution for loans to MSEs under the Reactiva Perú program is competitive in the Peruvian financial market.

Theoretical framework

Classification of MSEs according to sales

According to the Decreto Supremo N.° 013-2013-PRODUCE (2013, Section 4.- Definición de la Micro y Pequeña Empresa):

La Micro y Pequeña Empresa es la unidad económica constituida por una persona natural o jurídica, bajo cualquier forma de organización o gestión empresarial contemplada en la legislación vigente, que tiene como objeto desarrollar actividades de extracción, transformación, producción, comercialización de bienes o prestación de servicios [The micro and small enterprise is the economic unit constituted by a natural or legal person, under any form of organization or business management contemplated in the legislation in force, whose purpose is to develop activities of extraction, transformation, production, commercialization of goods or provision of services]. (p. 7)

Micro and small enterprises should be classified into the following business categories according to their annual turnover:

Microenterprise: Annual turnover of up to 150 UIT (tax units).

Small enterprise: Annual turnover over 150 UIT up to a maximum of 1700 UIT.

Trust

According to the experts of Gestiopolis (2021), a trust is an inheritance substitution tool in which a person transfers the ownership of certain assets to another person so that the latter can manage them for the benefit of a third party.

The subjects that are part of the trust are shown in Table 1:

Table 1. Structure of a Trust.

|

Trustor/settlor |

Constitution of trust. Transfers the assets to the trustee. |

|

Trustee |

Receives the assets transferred from the trustor. Manages the purpose entrusted by the trustor. |

|

Beneficiary |

Administration of trust assets. It may be the same trustor. It is the object of the purpose to be fulfilled by the trustor. |

|

Trustee |

Final beneficiary of the trust assets. |

Source: Gestiopolis (2021).

Reactiva Perú Program

It was established by Decreto Legislativo N.° 1455 and amended by Decreto Legislativo N.° 1457. It states that the main objective of the Reactiva Perú program is to encourage financing the replacement of working capital funds for companies with payment obligations or short-term obligations with their employees or suppliers of goods and services to ensure the continuity of payments (Section 2.1).

This program was implemented throughout the Peruvian financial system to respond quickly and effectively to the need for liquidity faced by companies due to the impact of the pandemic. Therefore, the following financial system enterprises (ESF) applied:

• Full-Service Banks.

• Finance company (Financieras)[5].

• Municipal Savings and Credit Institution (Caja Municipal de Ahorro y Crédito, CMAC)[6].

• Rural Savings and Credit Institution (Caja Rural de Ahorro y Crédito, CRAC)[7].

Through the Ministerio de Economía y Finanzas and Decreto Legislativo N.° 1455 (2020), the Peruvian National Government guaranteed the loans placed by the entities of the financial system with a maximum amount of thirty billion soles in guarantees. However, through Decreto Legislativo N.° 1485, published on May 9, 2020, these were increased by thirty billion soles resulting in a total of sixty billion soles in guarantees, whose administration was designated to Corporación Financiera de Desarrollo S.A. (COFIDE).

According to the operating regulations of the Reactiva Perú program, the applicability criteria established were as follows:

• It only covers new loans issued by the financial system enterprises to companies for working capital replacement purposes.

• Applicant companies must not have tax liabilities administered by SUNAT for periods before 2020 that are enforceable through mandatory levies greater than 1 UIT (S/. 4300 in 2020).

• As of February 2020, the applicant companies must be in the “normal” or “with potential problems” category in the classification of the financial system’s credit bureau of the Superintendency of Banking, Insurance and Private Pension Fund Administrators of Peru (Superintendencia de Banca, Seguros y AFP, SBS).

• If it does not have the category in the described period, it must not have been in any category other than “normal” in the 12 months before the issuance of the financing. In the event of not having a category in the last 12 months, it will be considered within the “normal” category.

• Not having links with the financial system enterprises issuing the loan and companies covered by Act N.° 30737 “Act that guarantees the immediate payment of civil reparations in favor of the Peruvian State in cases of corruption and related crimes”, enacted on March 12, 2018.

The main characteristics of the Reactiva Perú program applicable to financial system enterprises are as follows:

• It only applies to credits in local currency.

• The term of the loans issued may not exceed thirty-six months including a principal and interest grace period of up to twelve months.

• The guarantee provided by the program regarding the credits issued in favor of those companies that need to replenish their working capital through financing has as a maximum guarantee limit the lower amount between the amount equivalent to three times the annual contribution of the company to EsSalud[8] in 2019 and the average monthly sales of 2019 as registered in SUNAT.

• For microenterprises, the guarantee limit is determined by considering only the criterion of average monthly sales specified in the previous paragraph.

• The total amount of loans guaranteed per debtor company through the Reactiva Perú program must not exceed ten million soles.

• The guarantee provided by the program covers the outstanding balance of the loan granted, as indicated in Table 2.

Table 2. Guarantee Percentages - Reactiva Perú Program.

|

Amount of financing |

Guarantee Percentage |

|

Up to 30 000 |

98% |

|

[30 001 - 300 000] |

95% |

|

[300 001 - 5 000 000] |

90% |

|

[5 000 001 - 10 000 000] |

80% |

Source: Ministerio de Economía y Finanzas (2022).

It is worth mentioning that the Reactiva Perú program establishes a constant interaction between the fund management entity (COFIDE), the financial system enterprises, and the beneficiary companies. This happens because the operational flow involves a thorough evaluation of the eligibility criteria so that the Banco Central de Reserva del Perú can disburse the funds to the financial system enterprises to grant the cash to the beneficiary company.

METHODOLOGY

The type of research for the present study is quantitative in nature, descriptive in scope, with a cross-sectional methodological design and causal correlational type with the detail mentioned below, based on the types of research according to Hernández et al. (2014):

- Quantitative: This is a quantitative study because the analysis of key indicators and metrics will be sought through the collection and analysis of information.

- Descriptive: This is a descriptive study since it will analyze the existing information to identify the variability of interest rates compared to the average of the financial system between 2019 and 2020.

![]()

Where:

- M: Study sample

- X1: Independent variable

- Y1: Dependent variable

Study population and sample:

- Population: The population of this study is all the loans granted to companies that accessed the Reactiva Perú program through a financial institution of the Peruvian financial system, a total of 11 286 loans.

- Sample: Considering a confidence level of 95% (Z=1.96) and an expected probability of p = 0.5, a random sample of 372 loans was determined by statistical sampling.

RESULTS

Period Previous to the COVID-19 Pandemic (2019).

Some of the multiple financial products offered by the national financial system are the MSE loans (loans for micro and small enterprises) where the cost in terms of effective annual rate (EAR) is very high compared to loans for medium, large, and corporate companies. Table 3 shows the monthly evolution of these interest rates according to Banco Central de Reserva del Perú (2019).

Tabla 3. EAR by Type of Company - 2019.

|

Period |

Corporate Loans |

Loans to Large Companies |

Loans to Medium-Sized Companies |

MSE Credits |

|

Jan19 |

6.06% |

7.34% |

9.99% |

21.46% |

|

Feb19 |

6.07% |

7.32% |

10.00% |

21.32% |

|

Mar19 |

6.05% |

7.30% |

10.05% |

21.21% |

|

Apr19 |

6.06% |

7.19% |

10.05% |

21.04% |

|

May19 |

6.04% |

7.23% |

10.04% |

20.96% |

|

Jun19 |

6.09% |

7.24% |

10.02% |

20.83% |

|

Jul19 |

5.98% |

7.26% |

10.00% |

20.68% |

|

Aug19 |

5.95% |

7.22% |

9.99% |

20.56% |

|

Sep19 |

5.92% |

7.23% |

9.96% |

20.43% |

|

Oct19 |

5.85% |

7.17% |

9.91% |

20.31% |

|

Nov19 |

5.77% |

7.09% |

9.76% |

20.22% |

|

Dec19 |

5.56% |

7.06% |

9.81% |

20.07% |

Source: Banco Central de Reserva del Perú (2019).

The descriptive statistics of the information displayed in Table 3 are shown in Table 4.

Table 4. Descriptive Statistics - EAR per Type of Company.

|

Statistics |

Corporate |

Large Companies |

Medium-Sized Companies |

MSE |

|

Media |

0.05951 |

0.07222 |

0.09964 |

0.20758 |

|

Median |

0.06011 |

0.07230 |

0.09994 |

0.20757 |

|

Std. Dev. |

0.00157 |

0.00085 |

0.00094 |

0.00452 |

|

CoefVar |

2.64000 |

1.18000 |

0.94000 |

2.18000 |

|

Quartile 1 (Q1) |

0.05866 |

0.07175 |

0.09923 |

0.20339 |

|

Quartile 3 (Q3) |

0.06063 |

0.07293 |

0.10032 |

0.21165 |

|

Interquartile Range |

0.00198 |

0.00119 |

0.00109 |

0.00826 |

Source: Prepared by the author.

As shown in Table 3, there is a significant gap between these financings. This gap is based on the risk of non-payment according to the type of company requesting the financing as well as its credit history, and solvency, among other analysis variables considered by the financial institutions.

Regarding MSE loans, the study focused on and compared the EAR of the three main financial institutions in terms of market share to the bank under study using information from the Superintendencia de Banca Seguros y AFP (2019), which is shown in Table 5.

Table 5. Comparative EAR of MSE Loans per Bank - 2019.

|

Period |

Bank under Study |

Bank 1 |

Bank 2 |

Bank 3 |

|

Jan19 |

21.95% |

19.64% |

16.88% |

18.13% |

|

Feb19 |

22.22% |

19.55% |

17.59% |

19.00% |

|

Mar19 |

19.83% |

18.80% |

18.31% |

19.85% |

|

Apr19 |

19.75% |

19.00% |

17.95% |

19.76% |

|

May19 |

20.02% |

20.17% |

16.92% |

18.67% |

|

Jun19 |

19.77% |

19.98% |

16.13% |

19.13% |

|

Jul19 |

17.98% |

19.90% |

15.84% |

19.01% |

|

Aug19 |

19.39% |

21.79% |

16.37% |

17.80% |

|

Sep19 |

19.44% |

20.94% |

17.30% |

16.24% |

|

Oct19 |

18.50% |

20.16% |

17.32% |

16.44% |

|

Nov19 |

17.39% |

20.58% |

14.28% |

17.46% |

|

Dec19 |

16.82% |

20.38% |

12.50% |

20.11% |

Source: Superintendencia de Banca Seguros y Administradora de Fondo de Pensiones (2019).

As shown in Table 5, financing through MSE loans granted by the bank under study has a lower financial cost compared to two of the leading banks in the domestic market.

This is mainly due to the client segment to which the bank under study is directed. According to Resolución SBS N.° 14353 (2009), which establishes the definitions of types of loans, these segments are classified according to the type of applicant company as follows:

- Large enterprise.

- Medium-sized enterprise.

- Micro and small enterprises.

The evidence of the relative affinity of the bank under study to the aforementioned segments is the fact that the bank under study directs its commercial strategies and financial products to the medium-sized and large enterprise segments.

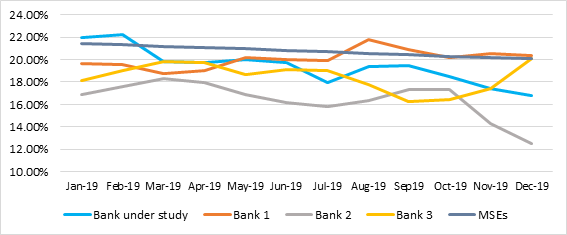

Figure 1 shows the comparison described in Table 5 about EAR at the market level for MSE loans.

Figure 1. Comparison of EAR for MSE loans by banking institution vs. market average EAR - 2019.

Source: Prepared by the author.

Regarding the EAR for MSE loans at the financial system level, bank 2 presents the most competitive rate, since it is at a very different level concerning the average throughout 2019. On the other hand, the bank under study is located in the last position of this comparison during the first half of 2019 because it is the entity that is closest to the market average, and even during the first two months, it is higher. However, during the second half of the year, it had a decreasing trend in its EAR for MSE loans compared to the competition, unlike Bank 1, which in the same period had an increasing trend.

Implementation Period of Reactiva Perú Program - 2020.

As reported by the Ministerio de Economía y Finanzas (2022), the Reactiva Perú program was received by the different types of entities belonging to the Peruvian financial system. Table 6 shows the participation by type of entity, and it shows all the loans issued through the Reactiva Perú program, indicating that 91% of them were through full-service banks.

Table 6. Share of Reactiva Perú Program Loan Issuance by Type of Entity - 2020.

|

Type of entity |

Number of Loans |

Share (%) |

|

Full-service banks |

65 255 |

91.20% |

|

CMAC |

5549 |

7.76% |

|

CRAC |

125 |

0.17% |

|

Finance companies |

624 |

0.87% |

|

Total |

71 553 |

100.00% |

Source: Ministerio de Economía y Finanzas (2020).

Table 7 shows the participation distribution of all the banks in the Peruvian financial system, which mostly included loans issued through the Reactiva Perú program. The bank under study was in second place in terms of the share of loans issued with 17.30%.

Table 7. Share of Loans Granted Under the Reactiva Perú Program per Bank - 2020.

|

Bank |

Number of Loans |

Share (%) |

|

Bank 1 |

44 677 |

68.47% |

|

Bank under Study |

11 286 |

17.30% |

|

Bank 4 |

2910 |

4.46% |

|

Bank 2 |

2856 |

4.38% |

|

Bank 3 |

2373 |

3.64% |

|

Bank 5 |

667 |

1.02% |

|

Bank 6 |

426 |

0.65% |

|

Bank 7 |

56 |

0.09% |

|

Bank 8 |

4 |

0.01% |

|

Total |

65 255 |

100.00% |

Source: Ministerio de Economía y Finanzas (2020).

Accordingly, as recorded by the Superintendencia de Banca, Seguros y AFP (2020), Table 8 shows the average EAR issued through the Reactiva Perú program of the 3 leading banks in the market compared to the bank under study.

Table 8. EAR of Loans Granted by the Reactiva Perú Program per Bank.

|

Period |

Bank under Study |

Bank 1 |

Bank 2 |

Bank 3 |

|

|

May20 |

Week 1 |

0.65% |

1.18% |

- |

1.10% |

|

Week 2 |

0.84% |

1.10% |

1.06% |

1.07% |

|

|

Week 3 |

0.98% |

1.00% |

1.07% |

1.12% |

|

|

Week 4 |

0.98% |

1.39% |

1.19% |

1.13% |

|

|

Jun20 |

Week 1 |

0.97% |

1.40% |

1.23% |

1.11% |

|

Week 2 |

0.98% |

2.10% |

1.11% |

1.12% |

|

|

Week 3 |

1.27% |

1.56% |

1.14% |

1.31% |

|

|

Week 4 |

1.23% |

1.33% |

1.23% |

1.42% |

|

Source: Superintendencia de Banca, Seguros y AFP (2020).

The previous table shows that the EAR offered by the bank under study was lower during the term of the Reactiva Perú program compared to the three leading banks in the market.

Likewise, there is a notable difference between the descriptive statistics of the financial cost of MSE loans and the Reactiva Perú program in terms of the structure of the cost of financing.

According to Indecopi (2024), the financial cost of a loan is mainly made up of:

- The credit profile of the financing applicant.

- The term of the financing.

- Other expenses and commissions.

However, according to Resolución Ministerial N.° 134-2020-EF/15 (2020), which approves the operating regulations for financing through the Reactiva Perú program, Section 9, states that the financial cost for this type of financing is mainly expressed as follows:

- Reactiva Perú commission - 0.5% per year on the outstanding balance of the debt.

- Interest rate auctioned by the Banco Central de Reserva del Perú.

Hypothesis Testing

Before testing the hypothesis of this article, a normality test was performed on the data referring to the variables Sample interest rate and Average interest rate of the financial system for MSE loans.

![]()

![]()

![]()

The results of the normality test are shown in detail in Table 9 through the Anderson-Darling test.

Table 9. Normality test - Sample Interest Rate and Average Interest Rate of the Financial System for MSE Loans.

|

Variable |

Study Sample |

Financial System - MSE Loans |

|

Media |

0.00845 |

0.20758 |

|

Anderson- Darling |

3.74600 |

0.16500 |

|

p-value |

< 0.005 |

0.92100 |

Source: Prepared by the author.

The preceding table shows that the p-value of the Anderson-Darling normality test shows a result of less than 0.005 for the interest rate variable of the study sample and a p-value of 0.921 for the average interest rate of the financial system for MSE loans. This means that the study sample does not come from a normal distribution, however, the average rate of the financial system does come from a normal distribution, which is why the H0 is rejected, and it is concluded that the data are not normal.

The null hypothesis, alternative hypothesis, and alpha error of this article are stated below:

- H0: The interest rate granted by the bank for loans under the Reactiva Perú program to MSEs is not competitive in the Peruvian financial market.

- H1: The interest rate granted by the bank for loans under the Reactiva Perú program to MSEs is competitive in the Peruvian financial market.

-

![]()

In this regard, Table 10 shows the result of the percentage variability of the EAR of MSE loans at the Peruvian Financial System level compared to the average EAR of the study sample for the Reactiva Perú program.

Table 10. Analysis of variability of average EAR of MSE loans (2019) vs. average EAR of Reactiva Peru loan sample (2020).

|

Average EAR MSEs (2019) |

Average Reactive EAR Peru (2020) |

Variability (%) |

|

20.758% |

0.845% |

−95.93% |

Source: Prepared by the author.

The table above shows a 96% decrease in the average APR of loans issued by the Reactiva Perú program concerning the market APR for MSE loans, which shows a high competitiveness of the APR granted in financing through the Reactiva Perú program.

However, to test the competitiveness statistically, and having evidenced that the data did not come from a normal distribution, the Mann-Whitney test for non-parametric data was used:

![]()

![]()

![]()

Where:

n1: average EAR of the study sample

n2: Actual average market EAR

Table 11 shows the results of the Mann-Whitney test, which shows that the p-value is less than the significance level, so Hypothesis H0 is rejected, and the alternative hypothesis is accepted. It can be concluded that the EAR offered in the Reactiva Perú program is competitive in the Peruvian market.

Table 11. Results of the Mann-Whitney Statistical Test.

|

Sample |

N |

Median |

W-value |

p-value |

|

Study Sample EAR |

372 |

0.00840 |

69378 |

< 0.0005 |

|

Market EAR |

12 |

0.20757 |

Source: Prepared by the author.

DISCUSSION

Regarding the dependent variable Competitiveness, it is observed that in the Peruvian financial system before the implementation of the Reactiva Perú program, loans to MSEs had the highest interest rate compared to loans granted to corporate, large, and medium-sized companies, which is evidenced by the results shown in Table 2.

For this reason, in the face of the COVID-19 pandemic, the enterprises, mainly MSEs, stopped receiving almost all income from their business activities, which led to the need for financial support from the State, since at the end of 2020 there was a drop of 48.8% in the presence of MSEs in the national territory (Sociedad de Comercio Exterior del Perú, 2021).

After the implementation of the Reactiva Perú program, the interest rate granted to the market by the bank under study was highly competitive, as shown in the results of Table 9.

The Reactiva Perú program significantly impacted companies facing challenges due to a lack of income from their commercial activities and pressing need for liquidity. It provided an injection of funds at a financial cost well below the market average for MSE loans. As a result, cash flow was not drastically impacted; with minimal financing costs, the financial expenses associated with the loans will remain manageable for the company.

CONCLUSIONS

The interest rates offered by the bank under study through the implementation of the Reactiva Perú program were competitive within the Peruvian financial market since they were below the average market cost for MSE loans.

The positive impact of the support programs was mainly on enterprises in the MSE segment. From the standpoint of reactivating the national economy, it was evident that the financing of working capital gave MSEs the ability to restart their operations through very low-cost financing with interest rates between 2% and 6% per year. From the standpoint of the national economy, support programs allowed for an expansion of the balance of the companies without harming their solvency, despite the great economic decline due to the COVID-19 pandemic and the measures adopted by the Central Government.

The impact of the low financial cost of the Reactiva Perú program (95% of the market average for MSE loans) granted greater access to credit for companies, mainly in the MSE segment. This allowed the continuity of its operational chain, which stimulated economic activity at the national level.

Financial institutions should generate a larger portfolio of products with a social purpose as a contingency in the face of unfavorable external conditions because, although the focus of all banking institutions is on profitability, it became evident that, in the face of an improbable external macroeconomic condition, the implementation of such products was necessary to avoid a further decline in the Peruvian economy.

It is advisable to determine the number of unsuccessful cases and their causes to contemplate proposals that will contribute to minimizing the occurrence of these situations and help the program achieve greater coverage of its objective.

REFERENCES

[1] Banco Central de Reserva del Perú. (2019). BCRP Data. https://estadisticas.bcrp.gob.pe/estadisticas/series/mensuales/tasas-de-interes-activas-promedio-de-las-empresas-bancarias-por-modalidad

[2] Cámara de Comercio de Lima. (2020, January 30). Credit to companies grows 5%. https://lacamara.pe/credito-del-sistema-financiero-a-empresas-crece-5/

[3] Decreto Legislativo N.° 1455. Decreto legislativo que crea el programa “Reactiva Rerú” para asegurar la continuidad en la cadena de pagos ante el impacto del COVID-19. (2020, April 6). https://busquedas.elperuano.pe/dispositivo/NL/1865394-1

[4] Decreto Supremo N.° 013-2013-PRODUCE. Ley de Impulso al Desarrollo Productivo y al Crecimiento Empresarial. (2013, December 28). https://busquedas.elperuano.pe/dispositivo/NL/1033071-5

[5] Gestiopolis (2021, November 8). Fideicomiso, qué es, para qué sirve, características, ventajas, tipos. Gestiopolis. https://www.gestiopolis.com/que-es-un-fideicomiso/

[6] Hernández Sampieri, R., Fernández Collado, C., & Baptista Lucio, P. (2014). Metodología de la Investigación. Mexico DF, Mexico: McGraw-Hill Education.

[7] Indecopi. (2024). Indecopi. https://indecopi.gob.pe/web/atencion-al-ciudadano/creditos-de-consumo

[8] Instituto Peruano de Economía. (2020, October 15). Boletín de discusión: Impacto del Covid-19 en Perú y Latinoamérica. https://www.ipe.org.pe/portal/wp-content/uploads/2020/10/2020-10-15-boletín-impacto-del-coivd-19-en-perú-y-latinomaerica.pdf

[9] Ministerio de Economía y Finanzas. (2020, December 31). Medidas para poner al Perú en marcha: Soporte de Cadena de Pagos. https://mef.gob.pe/planeconomicocovid19/soportecadenaspago.html

[10] Ministerio de Economía y Finanzas. (2022, April 27). Re Reactiva Perú: Conoce más de Reactiva Perú. https://www.gob.pe/institucion/mef/campa%C3%B1as/1159-reactiva-peru

[11] Resolución Ministerial N.° 134-2020-EF/15. Resolución Ministeral que Aprueba el Reglamento Operativo del Programa “REACTIVA PERÚ”. (2020, April 12). https://spijweb.minjus.gob.pe/wp-content/uploads/2020/04/RM_134-2020-EF-15_13_ABRIL.pdf

[12] Resolución SBS N.°14353-2009. Reglamento para la Evaluación y Clasificación del Deudor y la Exigencia de Provisiones. (2009, October 30). https://intranet2.sbs.gob.pe/dv_int_cn/968/v1.0/Adjuntos/14353-2009.r.pdf

[13] Sociedad de Comercio Exterior del Perú. (2021, June 18). El número de mypes peruanas se redujo un 48.8% en 2020 y la informalidad pasó al 85% como consecuencia de la pandemia. ComexPerú. https://www.comexperu.org.pe/articulo/el-numero-de-mypes-peruanas-se-redujo-un-488-en-2020-y-la-informalidad-paso-al-85-como-consecuencia-de-la-pandemia#:~:text=A%20ra%C3%ADz%20de%20la%20crisis,48.8%25%20menos%20que%20en%202019.

[14] Superintendencia de Banca Seguros y AFP. (2019). Tasas de interés promedio. https://www.sbs.gob.pe/estadisticas/tasa-de-interes/tasas-de-interes-promedio

[15] Superintendencia de Banca Seguros y AFP. (2020). Tasas de interés por tipo de crédito y empresa - REACTIVA PERÚ / FAE-MYPE. https://www.sbs.gob.pe/app/stats_net/stats/EstadisticaSistemaFinancieroResultados.aspx?c=RPFM-001